General Anti Avoidance Rules (GAAR) in India

Tax evasion and avoidance is a major issue in every country. Tax payers can choose tax efficient methods but it should not be solely for the purpose of obtaining tax benefit. GAAR have been introduced to overcome these problems.

The Central Board of Direct Taxes (CBDT) vide Press Release dated January 27, 2017 clarified that GAAR will apply from Assessment Year (A.Y.) 2018-19 i.e. Financial Year (F.Y.) 2017-18 onwards.

GAAR reflects the ‘substance over form’ principle. By invoking GAAR, a transaction may be considered void for tax purposes if there is no business reason underlying the transaction, or if the transaction is given a legal form which does not correspond to its actual character. However, a bona fide transaction shall not be covered if the primary purpose is other than tax avoidance even in circumstances when tax benefit is substantial.

Many countries like United Kingdom, China, South Africa, Australia, Canada, Brazil have incorporated these rules in their domestic tax laws to deal with aggressive tax planning.

Treaty V/s GAAR:

Tax treaties entered into with various countries to avoid double taxation also contain certain anti- avoidance rules such as the Limitation of Benefit (LOB) clause, Concept of Beneficial Ownership, etc.

Where a particular issue of avoidance is sufficiently addressed through the LOB clause in the treaty then the provisions of GAAR may not be invoked.

Applicability of GAAR - Conditions for invoking GAAR:

For Indian GAAR provisions to be invoked, there must be an impermissible avoidance arrangement entered into by a taxpayer. Accordingly, for GAAR to be invoked, the following conditions need to be established:

-

There must be an arrangement; and

-

The arrangement is an impermissible avoidance arrangement (IAA)

Condition 1: There must be an arrangement

The Indian tax laws define an arrangement as a part or whole of any transaction, operation, scheme, agreement or understanding (whether enforceable or not), all steps therein, and includes the alienation of property involving a transaction, operation, scheme, agreement or understanding.

However, the terms transaction, operation, scheme, agreement or understanding have not been defined/ explained in the context of the Indian tax laws.

Condition 2: The arrangement is an impermissible avoidance arrangement

The focus of GAAR is impermissible avoidance arrangement. GAAR comes into play in case of the transactions which are legally effective in conformity with the provisions of the law and not sham, but devoid of economic substance and carried out with the sole purpose of obtaining tax benefit and the arrangement is;

-

Non- Arm’s Length Dealing

-

Direct or Indirect abuse/misuse of the provisions of the law

-

Lacks/deemed to lack commercial substance

-

Entered into, or carried out, by means, or in a manner, which are not normally employed for bona fide purposes.

Accordingly, in order for an arrangement to be an impermissible avoidance arrangement, both the above tests have to be satisfied i.e. the main purpose is to obtain tax benefit AND either of the four tainted tests mentioned above has to be satisfied.

Consequences of an impermissible avoidance arrangement

Where an arrangement is regarded as an impermissible avoidance arrangement, the authorities may;

-

Disregard/combine/recharacterize any step, part or the entire arrangement.

-

Disregard any accommodating party/corporate structure.

-

Deem connected persons/ accommodating parties to be one and the same.

-

Reallocate receipts, expenditure, deduction, relief, rebate among parties.

-

Treating the place of residence, transaction, situs of an asset as a place other than the place as mentioned in the arrangement.

Guidelines:

The guidelines provide that the threshold for invoking the provisions of GAAR is tax benefit of INR 3 crores (0.3 billion). It is noteworthy that GAAR will not apply to Foreign Institutional Investors where they satisfy a set of conditions as laid down under the rules. GAAR shall not only apply to the entire arrangement but may also apply to any step or part of the arrangement where it is proved that such part or step is an IAA.

Now the question that arises is what will be the treatment with respect to arrangements which are entered into prior to the commencement of GAAR?

The guidelines explicitly provide that such arrangements shall be grandfathered i.e. the erstwhile provisions shall continue to apply and GAAR will not be invoked.

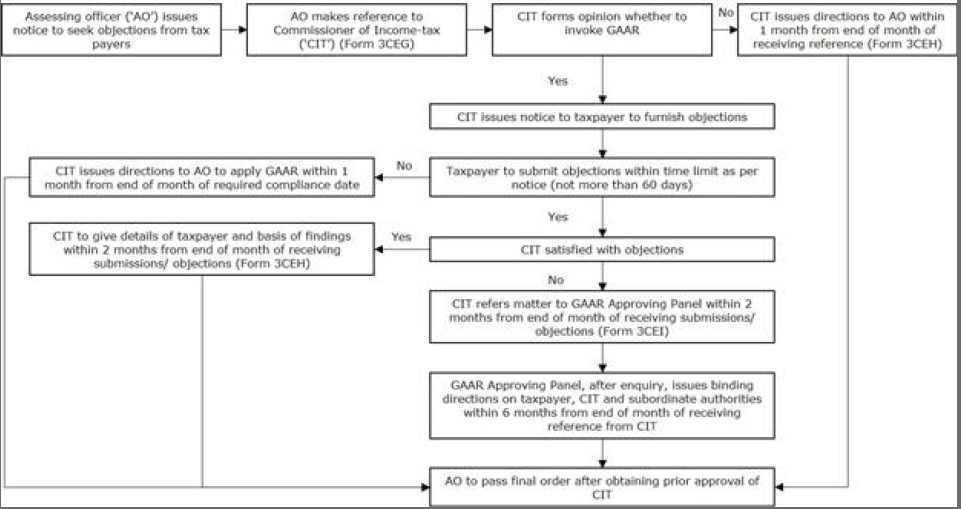

Procedure for invoking GAAR:

Conclusion:

GAAR is intended to target taxpayers, especially companies and investors trying to route investments through tax haven countries and avoid paying taxes. As it works on the principle of substance over form various tax avoidance arrangements will be curtailed by these provisions and will thereby compel the tax avoiders to pay taxes or avoid entering into such arrangements.

U. S. Gandhi & Co.

Kunal Gandhi